Every silver investor is drawn to different products, carefully picking and choosing their purchases according to which shiny thing catches their eye. Perhaps you select a product because of its beautiful design, or maybe you’re more interested in lasting secondhand value. Whatever the case, we’ve put together a general list of must-have silver products that have garnered a lot of attention and respect within the stacking community.

#1: 2018 American Silver Eagle

- Silver Eagles, also known as ASEs, are the most popular and recognizable silver bullion coin in the world. You can easily buy and sell them in many places.

- The US Mint produces a very high-quality strike with each ASE.

- ASEs are backed by the US government and are therefore stamped with a face value.

Cons

- The ASE’s design remains the same with each annual release (though some people consider this a positive trait of the coin).

- Sovereign-minted coins have a higher premium than privately-minted rounds.

- For those who collect ASEs with varying dates, some key dates (such as 1996) can be very expensive.

- No security features are built into this coin.

#2: 2018 Canadian Silver Maple Leaf

- The Silver Maple is the second most popular silver bullion coin in the world, following the Silver Eagle above. This lends to its availability and liquidity.

- The Royal Canadian Mint continuously improves the design over the years with security features like radial lines, micro-engraving, bullion DNA technology, and more.

Cons

- Canadian bullion coins have a history of developing spots over time.

- Silver Maples comes in rolls of 25 instead of 20, which might make it difficult to fit rolls into some storage methods.

- Some people tire of Queen Elizabeth II’s effigy on the obverse of Canadian bullion coins.

#3: Provident Silver Buffalo Round

- Though privately minted, this silver round maintains a high-quality strike and exceptional relief.

- You can purchase Silver Buffalos at a lower premium than many sovereign-minted products.

- These rounds are IRA-eligible.

Cons

- Silver Buffalos are not backed by a government, and are therefore not denominated.

- No security features have been added to these rounds.

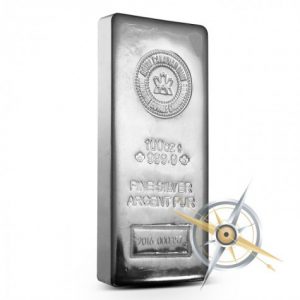

#4: Royal Canadian Mint 100 oz Silver Bar

- The RCM 100 oz silver bar is made with .9999 fine silver, which is often desired over .999 fineness.

- The attractive poured design bears the Royal Canadian Mint seal, an individual serial number, and the year of production. This makes each bar unique and identifiable.

- You can buy this bar at a low premium.

Cons

- This bar does not feature intricate or artistic design elements. Some investors are drawn to products that can double as artwork.

- The 100 oz bar must be sold at once, and cannot be broken down into smaller increments.

#5: 2018 British Silver Queen’s Beast Unicorn

- The historical design of the Queen’s Beasts Unicorn displays a high-quality sculpt and strike.

- While many bullion coins weigh 1 oz, this unique coin contains 2 oz of silver.

- The Queen’s Beasts series will eventually have 10 designs, which lends well to collecting and fostering a community of stackers.

Cons

- Silver Queen’s Beasts coins tend to have a high premium.

- Because of their larger size, you may face limited storage and display options when it comes to plastic capsules, albums, and more.

- Past issues in the Queen’s Beasts series have climbed in value, which may affect liquidity, especially if you’re selling a large quantity. Buyers may not be willing to pay the premium for the whole stash.

Bonus: 90% Silver Junk Coins

- Buying junk silver allows you to invest in the metal for relatively low premiums (though they do fluctuate).

- These coins carry historial and numismatic significance.

- Junk silver coins come in small sizes and varieties, making it easier to sell small increments of silver.

Cons

- Junk silver coins will arrive in a variety of designs and levels of wear, which could make their individual weights inconsistent.

- Coins that have been in circulation might be dirty, leading to messy handling.

- A limited supply of these coins can cause wild premium fluctuations (which can work to your benefit if the timing is right).

- Each $1 coin contains an average of .715 oz of silver, which can make the math difficult when it comes to determining how much silver you’ve collected.

These are some of our top recommendations for silver stackers, based largely on popularity that we’ve seen. And while these silver products are top sellers, there are plenty more products available that might interest you. Which silver products would you add to this list? Let us know in the comments below.

Also, check back next week for a similar “top products” list for gold bullion!

When you go to sell… Remember what most buyers will say. An ounce of silver is an ounce of silver. Spot price at the time will dictate your buyer’s offer. That’s why I personally stick to non-graded bullion such as the buffalo rounds. Nice to mix a small % of junk 90%, US Eagle’s and Canadian leafs in your collection for simple diversity. Nothing wrong with rare or high grade coins if you can afford them. Even jewelry and sterling silverware are a means to accumulate both value and variety. Just saying beware and research your investments before investing. It’s easy to get burned out there.

Some very sound advice. Thanks for sharing, Ron!

Correct, paying premiums on PMs will avail one very little, if anything when it comes time to exercise one’s liquidation plan (that’s fancy for sell). That is why I purchase quality rounds. An ounce of PM is just an ounce of PM to a retail buyer.

I have almost all my Bullion in Eagles, then Maple leafs. You get sick of that and around 20 % in semi numismatic Bullion.

I’ll take the Mexican libertad over the silver Buffalo.

The Libertad is a beautiful coin!

“Junk” silver has history. Think of how many things have been purchased with these coins. And how much more the coins could purchase then.

That’s part of the appeal to many collectors!

How soon until uk l you deliver to Minnesota Again???

We have been working diligently with our lawyers to resume sales to Minnesota and we’ve made a lot of progress. Right now, we’re waiting for the state to respond to the paperwork we’ve filed. Hopefully that happens quickly and we can resume sales within the coming weeks.

90% Silver have the advantage of already being “broken down” as long as you buy a variety of denominations

Yes, that’s one of the reasons people enjoy investing in it.

Advantage: 90% silver coins. In a monetary collapse you can break down larger denominations. IE: You’ll be one of the few out there who is giving change.

Some good advice. Thanks Jim!